Q1 2019 Report: Softening Rents in UAE and Long-Awaited Stabilisation of Dubai Property Prices

The UAE real estate market is capturing more attention than ever and with the first quarter of 2019 complete, investors and renters are eager to know more about Dubai property prices and trends. Bayut has compiled a comprehensive report on Dubai property prices and trends, along with prominent changes in Abu Dhabi, Sharjah and Ajman. To do so, Bayut’s data team has compared property prices from Q1 2019 to those from Q4 2018. Read on to discover the top areas to buy and rent apartments and villas in the UAE’s most populated cities.

The CEO of Bayut, Haider Ali Khan, stated, “We at Bayut have always been data-focused and our aim is to be at the forefront of assessing the market trends based on the properties being listed by the real estate brokerage community.” He also said, “Over the past years, the market has gradually matured, and as this progression has taken place, investors need more credible information regarding the housing market, and we are working diligently in doing our part by presenting the information.”

DUBAI

Dubai property market trends reveal high interest in luxury areas in Q1 2019 such as Dubai Marina, Downtown Dubai and Arabian Ranches for both sales and rentals. Suburban locations such as Jumeirah Village Circle, Dubai Silicon Oasis and Dubai Sports City are also generating more interest from investors and renters.

The trends for Dubai property prices show that there have been decreases on average for sales and rental prices compared to Q4 2018, but these changes have remained modest.

RENTING IN DUBAI

Dubai Marina returns to the top spot for renting apartments in Dubai in Q1 2019. Property price trends in Dubai show that prices have stabilised for smaller units in the area, standing at AED 55k for studios and AED 80k for 1-bedroom apartments. However, 2-bedroom apartments in Dubai Marina have seen rental prices dip by 4.2%, dropping from AED 120k to AED 115k.

Other popular locations include affordable areas such as Al Nahda, International City, Deira and Bur Dubai. Dubai property prices in these areas have largely seen decreases between 1% – 4%. The most significant changes are a 9% drop in prices for 2-bedroom units in Deira, where rental prices have fallen from AED 90k to AED 80k in Q1 2019.

When it comes to villas for rent in Dubai, Mirdif remains the most popular area with residents. Trends for Dubai property prices reveal that the costs for renting have remained steady for 3 and 4-bedroom units in this suburban community, standing at AED 105k and AED 120k respectively. However, 5-bedroom villas in Mirdif saw rental prices fall by 6.7%, from AED 142k to AED 132.5k.

Other areas sought after by renters for villas in Dubai include Arabian Ranches, where prices have experienced no change since Q4 2018. Other significant changes have included a rise in prices in established communities such as Jumeirah and Al Barsha for 3-bedroom units, going up by 6.3% and 3.3% respectively.

BUYING IN DUBAI

Similar to renters, buyers also turn to Dubai Marina as their first choice for apartments in Dubai. Property price trends in Dubai show that units in this upscale area have seen minor decreases, standing at AED 800k for studios, AED 1.15M for 1-bedroom units and AED 1.9M for 2-bedroom units.

Other luxury areas such as Downtown Dubai and Palm Jumeirah are also popular with investors. Dubai property prices in these areas have dipped between 3% – 5%. More affordable, well-integrated communities like International City and Jumeirah Village Circle are also catching the eye of buyers. International City, in particular, saw prices drop for studios and 1-bedroom apartments by 6% and 5.6% respectively, while 2-bedroom apartments have witnessed an uptick, pushing prices up from AED 690k to AED 700k. The apartments in International City also has the best ROI in Dubai, delivering rental returns of 9.7%.

The established community of Arabian Ranches is the prime choice for investors interested in buying villas in Dubai. Price trends show that the most notable change is for 3-bedroom villas in Arabian Ranches, with costs to buy dropping by 7% from AED 2.79M to AED 2.6M. Meanwhile, prices for 4 and 5-bedroom units have largely remained stable.

Other popular areas for buying villas in Dubai are Palm Jumeirah and The Springs, and suburban communities like Dubailand and The Villa. 4-bedroom villas for sale in The Springs have seen the biggest price drop, falling from AED 2.9M to AED 2.66M over the first quarter of 2019. The Springs also offers the highest rental returns in Dubai for villas at 6.3%, for investors looking at buy-to-let properties in Dubai.

Find out more of the city’s top residential areas for Q1 2019 in Bayut’s in-depth Dubai market report.

ABU DHABI

The Abu Dhabi real estate market offers great opportunities for investors and renters in Q1 2019, with affordable property prices and excellent ROI. Search trends reveal that areas on the mainland, such as Mohammed Bin Zayed City, Al Reef and Khalifa City A, are also rising in popularity for buying and renting. Trends for property prices in Abu Dhabi reveal that apartments and villas have seen sales and rentals prices decrease marginally.

RENTING IN ABU DHABI

Property price trends in Abu Dhabi show that costs for renting apartments have declined on average, however, changes have been modest. Mohammed Bin Zayed City remains the popular choice with renters in the city, especially due to affordable prices and easy access to Dubai-Abu Dhabi Highway. The most significant price change was for 2-bedroom apartments in MBZ City, where rentals fell from AED 58k to AED 50k in Q1 2019. Otherwise, rental prices for studios and 1-bedroom average at AED 25.5k and AED 42k. The waterfront apartments of Al Reem Island also ranked amongst the top areas for Abu Dhabi residents. Prices to rent apartments in Al Reem Island saw minimal decreases under the 5.5% mark.

MBZ City also emerges as the winning area for renting villas in Abu Dhabi. There have been no significant price changes here, with rental prices averaging at AED 95k for 3-bedroom units, AED 130k for 4-bedroom units and AED 145k for 5-bedroom units. Other communities on the mainland such as Khalifa City A and Al Reef are also sought after by renters. Trends for Abu Dhabi property prices show that price changes here have largely been between 3% – 6%.

BUYING IN ABU DHABI

Prices for the apartments for sale in Abu Dhabi have not seen any major changes over the first quarter of 2019. Al Reem Island is most popular amongst investors in Abu Dhabi for apartments, with sales prices here seeing no notable changes. Meanwhile, prices to buy apartments in Al Raha Beach and Yas Island have appeared to bottom out for certain units, with only 1-bedroom units in Al Raha Beach seeing a significant drop in prices of 6.5%.

Search trends show that the community of Al Ghadeer along the Dubai-Abu Dhabi border has risen in popularity with homebuyers. Prices for certain units here have also seen an upswing, with 1-bedroom apartments standing at AED 587.5k and 2-bedroom units at AED 850k. This could be credited to the handover of many off-plan properties in the area, which in turn has pushed up prices. For investors looking at high rental yields in Abu Dhabi, the apartments in Al Reef boast the best ROI of 8.7%.

The Al Reef development, located close to the Abu Dhabi International Airport, is also the most popular location to invest in villas in the UAE’s capital. Abu Dhabi property price trends show that the cost of buying villas here has reduced marginally overall. Prices to buy 3-bedroom villas has dipped by 4.6% from AED 1.52M to AED 1.45M, while 5-bedroom villas have seen prices drop by 6.2% from AED 2.27M to AED 2.13M. Al Reef villas for sale also have the best ROI in Abu Dhabi at 7.1%.

Potential investors also consider luxury developments such as Yas Island and Saadiyat Island for buying villas. Property prices here have experienced minimal decreases.

Learn more about how the Abu Dhabi real estate market has fared over the first quarter of 2019 in our individual Abu Dhabi market report.

SHARJAH

The Sharjah real estate market continues to provide lucrative opportunities for investors and renters. Projects by well-known developers like Maryam Island are adding to the portfolio of properties in the market for investors. Meanwhile, Sharjah’s affordable lifestyle and family-friendly amenities make the emirate ideal for renters looking for budget-friendly homes.

RENTING IN SHARJAH

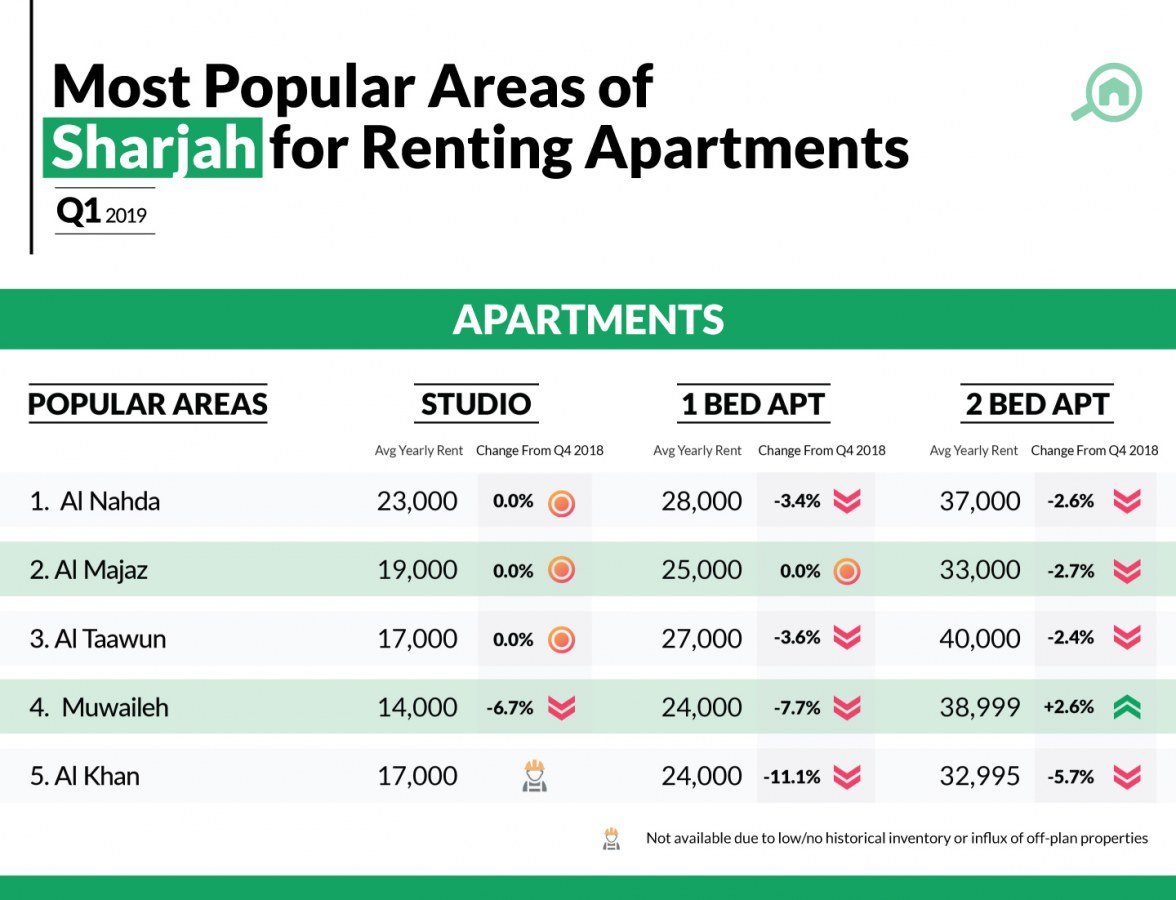

Once again, Al Nahda takes the title as the most searched-for area for renting apartments in Sharjah. Its proximity to Dubai makes it very popular with residents who commute regularly between the emirates. The rental prices here have remained largely stable in Q1 2019, standing at AED 23k for studios, AED 28k for 1-bedroom units and AED 37k for 2-bedroom units.

The waterfront location of Al Majaz also attracts significant interest from potential tenants. Trends for property prices in Sharjah reveal that the cost of renting apartments in Al Majaz has remained steady for smaller units, averaging at AED 19k for studios and AED 25k for 1-bedroom units. The most significant price change for rental apartments in Sharjah is an 11.1% drop for 1-bedroom units in Al Khan, from AED 27k to AED 24k.

Those interested in the villas for rent in Sharjah will find that the areas of Al Sabkha, Al Ghafia, Al Barashi, Al Jazzat and Al Sharqan generate the most interest from potential tenants. Al Sabkha is sought-after by renters for the number of amenities in the area, including supermarkets, nurseries and retail options.

BUYING IN SHARJAH

Property price trends in Sharjah indicate that the cost for buying apartments has declined between 2% – 6% across the emirate’s most popular areas. Al Majaz remains the top area for investors to buy apartments in Sharjah. Buying prices for 2-bedroom apartments in Al Majaz have fallen from AED 580k to AED 545k, which is the largest price change in Q1 2019.

Other popular areas also include Sharjah University City, which is located close to the Sharjah International Airport and other landmarks. Prices for apartments for sale in Sharjah University City have seen no changes over Q1 2019, standing at AED 325k for studios, AED 567k for 1-bedroom apartments and AED 870k for 2-bedroom apartments.

Potential investors looking at villas in Sharjah turn to Al Sabkha as their first choice, followed by Sharqan, Hoshi, Al Suyoh and Barashi.

Find out more about the best areas to buy and rent in the city in the Q1 2019 Sharjah market report.

AJMAN

Affordable prices and high ROI make the Ajman real estate market attractive for renting and buying. Property trends for Ajman show that interest is rising for more urban areas like Ajman Downtown that offer a comfortable lifestyle for lower prices, compared to Dubai and Sharjah.

RENTING IN AJMAN

Property prices in Ajman for apartments have experienced marginal decreases over Q1 2019, with prices stabilising for certain units in well-known areas. Al Nuaimiya, an area along the Sharjah-Ajman border, takes the crown for apartment rentals in the emirate. Prices for renting apartments in Al Nuaimiya have seen minimal changes, and stand at AED 17k for studios, AED 21k for 1-bedroom apartments and AED 33k for 2-bedroom apartments. Apartments in Ajman Downtown have seen prices decline between 4% – 6%, giving renters the opportunity to upgrade to this central location. The most notable drop in rental prices was for 1-bedroom apartments in Al Sawan, where prices fell from AED 30k to AED 28k.

Looking to rent villas in Ajman? Areas such as Al Rawda, Al Mowaihat, Al Jurf, Al Hamidiyah and Al Nuaimiya drew the lion’s share of overall searches for rental villas in Ajman.

BUYING IN AJMAN

In Q1 2019, Ajman Downtown holds the top position for buying apartments in Ajman. Buying prices for apartments in Ajman Downtown have experienced changes under 5%. Studios in the area have seen prices rise from AED 170k to AED 175k, while 2-bedroom units have dropped from AED 340k to AED 325k.

Meanwhile, 1-bedroom units in Garden City, Al Sawan and Al Nuaimiya have seen prices decline around 7% – 8% mark. The affordable prices provide buyers with an ideal opportunity to invest in Ajman real estate. The apartments in Al Nuaimiya also have the best ROI in Ajman of 13.8%.

Those keen on villas for sale in Ajman should consider the areas of Al Mowaihat, Al Rawda, Al Yasmeen, Al Zahra and Al Jurf, which were most searched for by potential homebuyers.

Learn more about where to invest in Ajman real estate in Bayut’s in-depth Ajman market report.

Q2 2019 FORECAST

Haider Ali Khan, CEO of Bayut, said, “The first quarter of 2019 appears to be continuing in the trajectory we observed in the last few months of 2018, with property prices remaining largely unaffected in prominent areas such as Dubai Marina, Arabian Ranches, Yas Island and Saadiyat Island or reducing marginally. An interesting trend we noticed in 2018, which continues in this quarter is the growth in search volume for more affordable, well-integrated, suburban neighbourhoods like Dubai Silicon Oasis, JVC, MBZ City and Al Ghadeer. These areas have incidentally shown a slight increase in prices but continue to remain popular because of their favourable reputation as well as high ROI. We can expect property trends in the other emirates to follow a similar route as Dubai, with Ajman and Sharjah taking the lead for affordable housing.”

And that brings an end to Bayut’s report on Dubai property prices and the UAE real estate market trends. We hope this report helps you in your investing and renting decisions for properties in the UAE! Stay tuned to MyBayut for more articles on property prices in Dubai, Abu Dhabi and other emirates.