Pros and cons of buying property in Dubai

One of the fastest-growing metropolises in the world, Dubai is known for its towering skyscrapers, scenic waterfront tourist destinations and some of the best malls in the world. Investors and homeowners alike are always looking to buy property in Dubai for its potential benefits.

But before investing, why not weigh the pros and cons of buying property in Dubai? Let’s take a look…shall we?

PROS OF BUYING A PROPERTY IN DUBAI

Choosing a suitable area to buy property in Dubai depends on your priorities, family size, budgetary constraints and if you are an investor, your financial goals. Fortunately, the range of affordable and unique residential communities makes the city a haven for property investors.

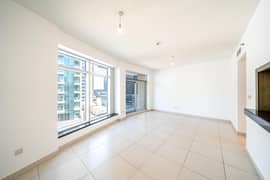

From affordable 1-bedroom apartments to luxurious villas and palatial townhouses for sale, there is something for every property investor or home seeker.

With countless new projects in the pipeline, Dubai has a promising real estate market with attractive prices. And that’s precisely why the time is certainly ripe for property investment in the emirate.

So, if you’re looking to purchase your dream home, here’s a step-by-step guide on how to invest in Dubai real estate. With this in mind, here are some benefits of buying property in Dubai.

- 3 BEDS

- |

- 4 BATHS

- |

- 2071 SQFT

- 2 BEDS

- |

- 2 BATHS

- |

- 933 SQFT

- 2 BEDS

- |

- 3 BATHS

- |

- 987 SQFT

- 1 BED

- |

- 1 BATH

- |

- 707 SQFT

HIGH RETURN ON INVESTMENT (ROI)

It’s well-known that properties purchased in desirable areas promise more ROI than others. According to Bayut’s Sales Market Report for H1 2024, International City, Dubai South, Jumeirah Village Circle (JVC), Business Bay, Dubai Marina, Downtown Dubai and DAMAC Hills 2 are the most popular areas to buy property in Dubai.

If you’re looking to buy affordable flats in JVC, the expected ROI is 8.65%. And if you’re looking for a luxury apartment in DAMAC Hills 2, the expected ROI is 6.97%.

AVAILABILITY OF AFFORDABLE OFF-PLAN PROPERTY

There are several benefits of buying property in Dubai. One obvious one is the option to buy off-plan property. This includes projects that have not been constructed yet and are available at significantly lower prices. The attractive payment plans and feasible offers make these developments a more lucrative option for investors.

Both first-time buyers and seasoned investors can benefit from the great financial flexibility offered by off-plan real estate in the emirate.

One of the main things to know before buying property in Dubai is to keep an eye on new developments. With several monthly projects announced, developers often start competing on favourable financial schemes and prices.

For example, a developer can offer a payment scheme that allows buyers to pay 50% upfront and 50% upon completion.

AVAILABILITY OF FREEHOLD AREAS

One of the crucial buying property in Dubai advice is to navigate the market effectively. The emirate has designated areas where expats or foreign nationals can invest in real estate.

Known as “freehold areas,” these localities offer international buyers properties in different configurations — with some communities offering apartments, villas or a mix of both.

Popular freehold areas in Dubai include Arjan, Business Bay, Barsha Heights, Downtown Dubai, Discovery Gardens, DIFC and Dubai Marina.

CONSISTENT DEVELOPMENT

The government is always working to make the city better and smarter. The constant development is another reason to buy property in Dubai. Whether it’s an artificial archipelago 2km north of its shoreline or the tallest building in the world, the emirate has proven that nothing is impossible.

New developments planned for upcoming years will surely introduce new road links such as The Loop (which will make the city accessible in 20 minutes), shopping malls and recreational centres. Hence, increasing the value of properties purchased.

Other noteworthy additions that will add significant value to purchased properties are the engineering innovations where developers have introduced smart technologies within villas and apartment buildings.

DUBAI PROPERTY VISA

Property investors are also eligible for long-term residency visas. Those with property investments amounting to AED 750k can now apply for the 2-year residence visa. Property investors can also sponsor their family members for this long-term visa, another benefit of buying property in Dubai.

Technological advancements

Those who want to buy property in Dubai have much to gain thanks to the emirate’s development towards becoming a smart city. With advanced facilities, an improved public transport system and innovative entertainment destinations, the city is the perfect place to live.

Examples include the RTA’s app and smart services, which residents can use to make their daily commute more convenient. Another step forward is Dubai Bus on Demand, making the emirate sustainable and smart.

IT’S ONE OF THE SAFEST CITIES IN THE WORLD

Dubai is considered one of the safest places to live in the world, ideal for families looking to call it home. The online Al Ameen Service enables residents to report crimes anonymously. Launching a Smart Police Station exemplifies how the city keeps its residents secure.

Aside from the latest smart solutions that can halt crime in its tracks, law enforcement agencies are pretty consistent in enforcing the law. A secure living environment is just one of the pros of buying a property in Dubai.

CONS OF BUYING A PROPERTY IN DUBAI

While there are definite perks to investing in the emirate’s real estate market, it’s also important to consider the general risks of buying property in Dubai before jumping into any investment.

On that note, here are some cons of buying a property in Dubai.

INITIAL PURCHASE AND ADDITIONAL COSTS

One of the things to consider when buying property in Dubai is the initial costs that come with the purchase. For example, those who purchase property directly from a developer must pay mandatory fees to the Dubai Land Department (DLD).

This includes the DLD fee, which is 4% of the property value, the fee for issuing the Title Deed and the administration fee — all of which need to be paid upfront. For more clarity, we recommend reviewing the costs of buying property in Dubai.

MORTGAGE CHARGES

Buyers who go for mortgages will have to pay a Mortgage Registration Fee to the DLD, which is 0.25% of the mortgage value, in addition to an admin fee. However, the news is good for investors who want to make full cash payments, as the Mortgage Registration Fee won’t apply to them. Reviewing available mortgages in Dubai will give you a better idea of options.

FAQS ABOUT THINGS TO KNOW BEFORE BUYING PROPERTY IN DUBAI

ARE THERE ANY RISKS INVOLVED IN BUYING OFF-PLAN PROPERTY IN DUBAI?

There can be delayed completion, project cancellation and market condition change. Read our guide on why buy off-plan property in Dubai.

WHICH ARE THE BEST AREAS TO LIVE IN DUBAI?

Dubai Marina is rated by many as the best place to live in Dubai. The area offers luxurious apartments for sale and rent. The apartments here have a healthy ROI of 6.95%.

CAN I BUY PROPERTY IN DUBAI DIRECTLY FROM THE OWNER?

Yes, you can. But we suggest you weigh the pros and cons of buying a property directly from an owner in Dubai before making your final decision.

WHAT IS RERA?

RERA (Real Estate Regulatory Agency) regulates and authorises the real estate sector in Dubai. If you’re in the process of buying or selling a property, here’s a guide to RERA forms in Dubai which will help you in making the whole process hassle-free.

IS THERE A MINIMUM SALARY REQUIREMENT TO BUY A PROPERTY IN DUBAI?

Yes! You are required to have a minimum salary of AED 15k. You can refer to our guide on how much salary is required for a home loan in Dubai for a better understanding of the breakdown and various other factors involved.

WHAT ARE THE MOST COMMON HOME BUYING MISTAKES IN DUBAI?

Some of the top house buyer mistakes to avoid in Dubai include rushing into a deal, not conducting sufficient research and miscalculation of costs.

And on that note, we conclude our comprehensive list of the things to consider when buying property in Dubai. Drawbacks aside, the city’s real estate market offers a slew of beneficial investment opportunities.

Looking to invest in commercial real estate? You should familiarise yourself with the top areas to invest in commercial property in Dubai. If you plan on buying joint property, you must educate yourself about the joint owned property laws in Dubai.